UPDATE: This article now reflects the final Senate Bill 2001, that was passed in special session on December 12, 2019.

The following is a commentary on the tax reform proposal passed out by the Tax Restructuring and Equalization Task Force on December 9, 2019.

Libertas Institute is taking a neutral position on the bill as it stands, while noting that this bill is a vast improvement from previous iterations.

On Thursday, the Utah Legislature was called into special session by Governor Gary Herbert in order to consider a tax reform proposal that has been debated and worked on for the past year. (Click here to access the latest draft.) From the initial proposal in House Bill 441 until now, there has been quite a bit of discussion and many moving parts.

The main reason that has been put forth of why these changes are needed is to fix state budgetary imbalances between some of the major tax revenue streams, specifically the sales tax and income tax. As a result, legislators have struggled to fulfill all obligations that should be funded out of the general fund. In order to mitigate some of the proposed tax changes, providing a significant net tax cut has also been an important goal.

What are the main points of SB 2001?

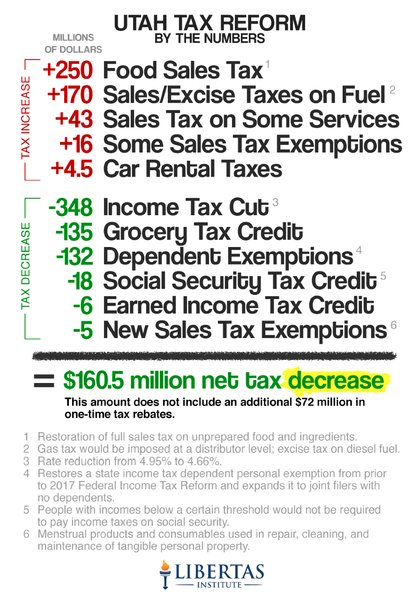

The following graphic outlines the key changes being made, with both tax increase and decreases included. The net effect is a proposed $160.5 million tax decrease.

What additional services are going to be taxed?

- Pet boarding/grooming/daycare

- Motor vehicle towing

- Peer-to-peer ridesharing

- Sightseeing transportation

- Parking lots/garages

- Dating referral services

- Identity theft protection

- Streaming media

- Electronic security monitoring

- Shipping and handling when part of a taxable sale

- Installation of tangible personal property when part of a taxable sale

Are there other items that will be also be newly taxed?

The following sales tax exemptions will be repealed:

- Electricity to ski chair lifts

- Vehicles used for temporary sporting events

- Admissions to college athletic events

- Textbooks purchased by a student from a non-college bookstore where the seller primarily sells textbooks

- Use of car washes, vending machines, unassisted amusement devices through machines that do not exclusively accept cash or coin

- Sales to a public transit district

- Fuel sold to a common carrier railroad and used in a locomotive engine

- Newspapers or newspaper subscriptions

- Address list or database used to send direct mail

- Database access for viewing or retrieving information

What is not in SB 2001?

There is no broad new sales tax on services. Instead, fewer than a dozen additional services will be taxed as a result of this bill—a significantly smaller proposal than all previous iterations of this year’s tax reform.

There is very little new tax pyramiding (taxes levied at multiple points in the production of goods/services) that would result from the enactment of this legislation that would negatively affect Utah businesses and consumers.

There is also no consideration being made in this proposal to remove the constitutional earmark that requires all income taxes to be spent on education. Along with that, there are no automatic property tax increases—a proposal that was once floated in exchange for removing the income tax earmark.

Is it really a $160.5 million tax cut?

Current estimates show that the average Utah family of four will see a nearly $500 tax cut per year as a result of this legislation.

There was some concern that the estimated effects on some of the new taxes were being underestimated and those discrepancies have been mitigated for the most part. The part that has not been fully mitigated is that local governments will see a small sales tax windfall as a result of the new services that will be taxed and the elimination of some sales tax exemptions. It’s also important to note that a portion of the tax increases will be felt by out-of-state residents and not Utah taxpayers. This would amount to about $31 million in additional relief to Utahns.

That being said, it is not fully known what the long term effects of taxing internet sales will be on state sales tax receipts. This issue may need to be revisited in the future if the state receives more sales tax revenue than expected.

In the final analysis it is likely that Utahns will see a $160.5 million tax cut as a result of this bill.

Won’t this just result in a tax increase in the long run?

Considering that personal and corporate income tax revenues grow at a much faster rate than food or fuel tax revenues, the tax shifting contained in this proposal should result in a trajectory amenable to taxpayers. In other words, government coffers will expand at a slower rate under this new proposal. Even with new sales taxes on a few services, this tax reform should result in a significant long term tax decrease—not just the one being analyzed for the short term.

Are there some one-time tax benefits that taxpayers will see as a result of SB 2001?

Utah taxpayers who claim dependents will receive a one-time check for up to $200 around February or March of next year.

Those who would qualify for the new grocery tax credit will receive a one-time check in July. Up to $125 for a family of four, with the amount increasing or decreasing dependent on the number of individuals in the household.

Other than the tax cut, what does this tax reform accomplish?

This tax reform temporarily allows greater flexibility in the state budget for Utah legislators as they adopt a budget each year. Specifically, this tax reform calls for funding school lunches and underage drinking prevention out of the education fund (income taxes) and funding about $400 million of the higher education appropriation out of the general fund (sales taxes) rather than the education fund.

The proposal also calls for about $30 million in spending cuts from the state budget. This would be accomplished by a variety of executive agencies implementing efficiency strategies to trim their budgets. This bill also targets $5 million in transportation funds to rural county road funds.

This tax reform does not fully address issues that are created by the transportation earmark in the general fund, ballooning costs in higher education, and diminishing tax revenues from sales taxes. As these issues persist, they will continue to put pressure on Utah’s state budget, particularly the general fund. These issues present a persistent need for significant structural tax reform beyond what is currently being discussed.

What comes next?

We remain concerned about an effort to index property taxes to inflation in order to bypass the “Truth in Taxation” process that allows for public accountability when local elected officials want to increase property tax rates. This would be done in exchange for removing the constitutional earmark requiring income taxes to be used for education. If this proposal is brought up during near year’s legislative session, Libertas Institute will oppose that effort since it would threaten to wipe out the gains from this month’s task reform with automatic property tax increases. In short, the tax decrease in this special session proposal would be eliminated by a tax increase in the general session.

Assuming that the Legislature will not seriously consider that idea, we believe that these tax reform efforts likely could result in a win for taxpayers. It’s unfortunate that the compressed timetable makes it hard to produce extensive analysis and even harder for taxpayers to quickly get up to speed and have the opportunity to even consider supporting this tax reform proposal. In time, the effects of this tax reform will have to stand on their own and taxpayers will decide if it was helpful to them.

Where should the Utah Legislature focus its tax reform efforts from here?

The Legislature needs to address the continued problems that come from fuel taxes and fees that do not act as a true user fee for Utah’s transportation network. This tax reform proposal recognizes that the additional taxes on fuel only amount to a temporary band-aid until a more equitable user fee system can be developed to fund transportation. Achieving a solution to this problem will do more to relieve the strains on Utah’s general fund than this bill does.

Additionally, higher education has continued to draw more and more funding from the education fund each year since 1996, when a constitutional change was made to allow income taxes to pay for higher education appropriations. This trend is temporarily mitigated by this tax reform proposal, but will continue to cause problems in the long run. Considering that higher education needs to more quickly adapt to the changing landscape of education and workforce training by moving away from brick and mortar education models, Utah legislators need to throw less money at the problem—not more.

A combination of transportation funding reform and higher education spending reform has the potential to bring long term state budget flexibility for Utah, which should result in better outcomes and lower taxes for Utah taxpayers. At that point, Utah may be ready to return to the idea of taxing all end consumption with a sales tax, while eliminating as many taxes on business inputs as possible.